MBS Road Signs 7-22-24

Week of July 15, 2024 in Review

Home builder sentiment remains below a key threshold while there was an important caveat to the rise in construction projects last month. Plus, more signs are signaling a slowdown in economic activity. Read on for these stories and more:

- Home Builder Sentiment Held Down by Higher Rates

- Construction Activity Boosted by Multi-family Projects

- Retail Sales Remain Flat

- Initial Jobless Claims Hit 5-Week High

- Latest LEI and Beige Book Suggest Slowing Economic Activity

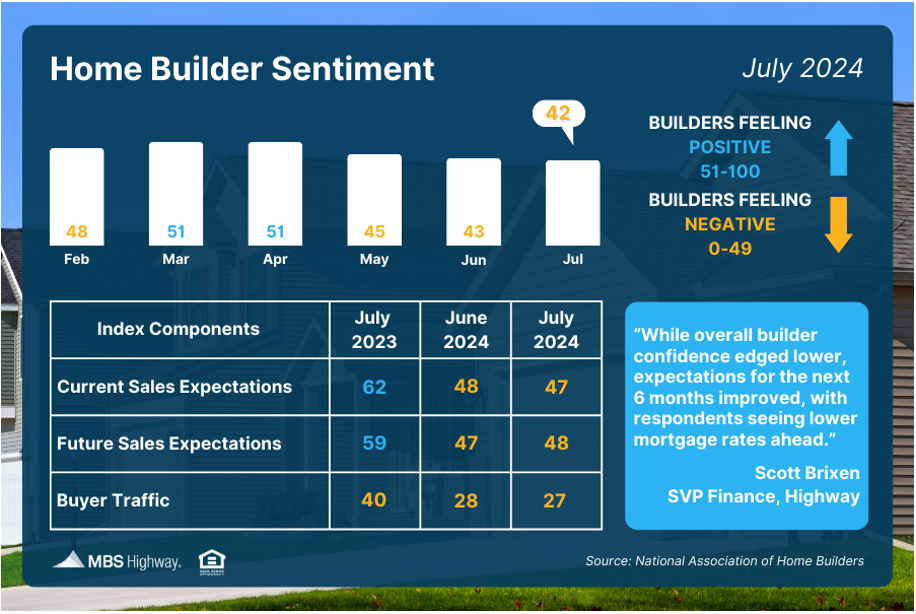

Home Builder Sentiment Held Down by Higher Rates

Confidence among home builders remains below the key breakeven threshold of 50, per the National Association of Home Builders (NAHB), as their Housing Market Index dropped 1 point to 42 in July. This marked the third consecutive monthly decline and the lowest reading since December as higher rates continue to dampen sentiment. Scores over 50 on this index, which runs from 0 to 100, indicate that most builders feel confident about the current and near-term housing market outlook, whereas lower readings signify there’s less optimism among builders.

What’s the bottom line? Though all three index components (buyer traffic, current and future sales expectations) remained below 50, NAHB Chair, Carl Harris, noted that “the six-month sales expectation for builders moved higher, indicating that builders expect mortgage rates to edge lower later this year as inflation data are showing signs of easing.”

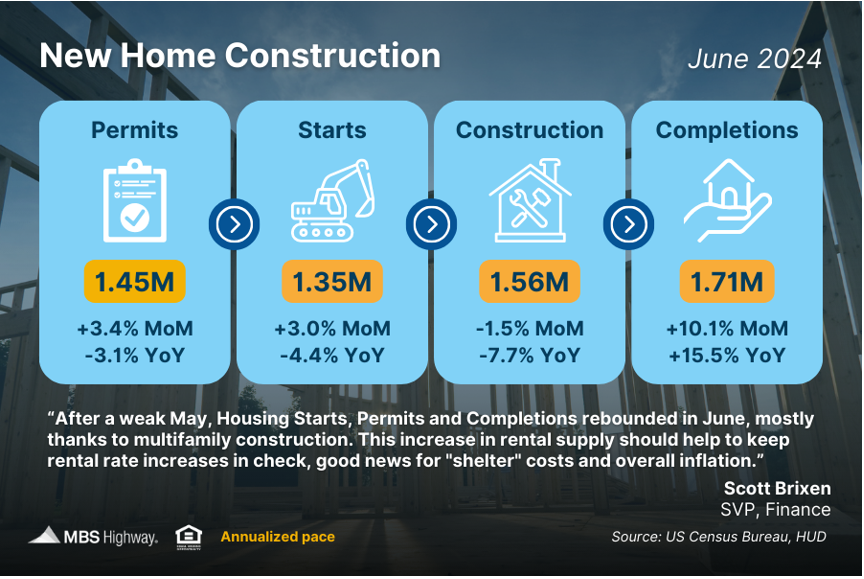

Construction Activity Boosted by Multi-family Projects

After a disappointing May, new home construction ticked higher in June as Housing Starts and Building Permits both came in above estimates. However, the increase was led by a boost in multi-family projects, as starts and permits for single-family homes both moved lower.

What’s the bottom line? Softer than expected construction activity this spring could limit much needed supply down the road, especially among single-family homes. This bodes well for appreciation and shows that opportunities remain to build wealth through homeownership.

Retail Sales Remain Flat

Retail Sales stayed flat in June, though this was better than the outright decline that had been expected. Sales in May were also revised upward from the originally reported 0.1% gain to a 0.3% gain when compared to April.

What’s the bottom line? While this report was better than estimates, there has been growing evidence that consumers are spending more cautiously in the face of rising unemployment and a slowing labor market. The Fed will be closely watching future Retail Sales reports, as the strength of our economy will impact their monetary policy decisions this year.

Initial Jobless Claims Hit 5-Week High

Another 243,000 people filed new unemployment claims in the latest week, marking an increase of 20,000 from the previous week and tying the highest level since early June. Continuing Claims also rose by 20,000, as 1.867 million people are still receiving benefits after filing their initial claim.

What’s the bottom line? The pace of layoffs continues to move higher, as does the number of people who are already collecting benefits. Plus, this latest Initial Jobless Claims reading was an important real-time report because it includes the sample week that the Bureau of Labor Statistics will use in the modeling for their job growth estimates for July’s Jobs Report. While this is just one component, the high reading of 243,000 initial unemployment claims could point to weaker job growth when July’s report is released on August 2.

There have been growing calls for the Fed to cut their benchmark Fed Funds Rates at their meeting on September 18, given signs of cooling inflation, rising unemployment and a softening job market. Labor sector data released between now and then will play a pivotal role in this decision.

Latest LEI and Beige Book Suggest Slowing Economic Activity

The Conference Board released their latest Leading Economic Index (LEI), which takes a broad look at the economy and tracks where it’s heading in the near term. June brought a 0.2% drop, which followed May’s upwardly revised 0.4% decline.

What’s the bottom line? “The US LEI continued to trend down in June, but the contraction was smaller than in the past three months,” explained Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators. The Conference Board predicts that “economic activity is likely to continue to lose momentum in the months ahead,” with cooling consumer spending pushing “GDP growth down to around 1% (annualized) in Q3 of this year.”

This correlates with the Fed’s latest Beige Book, which is a survey of economic conditions around the country. Five of the Fed’s 12 districts reported flat or declining economic growth, which was up from only two districts six weeks ago.

Family Hack of the Week

National Peanut Butter and Chocolate Day is July 23. These Peanut Butter Bars courtesy of Allrecipes are a perfect way to enjoy this winning combination.

In a medium bowl, mix 2 cups graham cracker crumbs, 2 cups confectioner’s sugar, 1 cup butter and 1 cup peanut butter until well blended. Press evenly into the bottom of an ungreased 9×13-inch pan. In a microwave safe bowl, add 1 1/2 cups chocolate chips and 4 tablespoons peanut butter. Microwave on high, stirring every 15 seconds, until smooth. Spread mixture over crust.

Refrigerate for 1 hour before cutting into 12 squares.

What to Look for This Week

More housing reports are ahead, with June’s Existing and New Home Sales releasing on Tuesday and Wednesday, respectively. Look for the first reading on second quarter GDP and the latest Jobless Claims on Thursday, while Friday brings the most crucial report of the week via the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds fell below an important support level at 100.914 on Friday. If they remain below this level, the next floor is their 25-day Moving Average. The 10-year tested an important ceiling at 4.25%, which held on Friday.