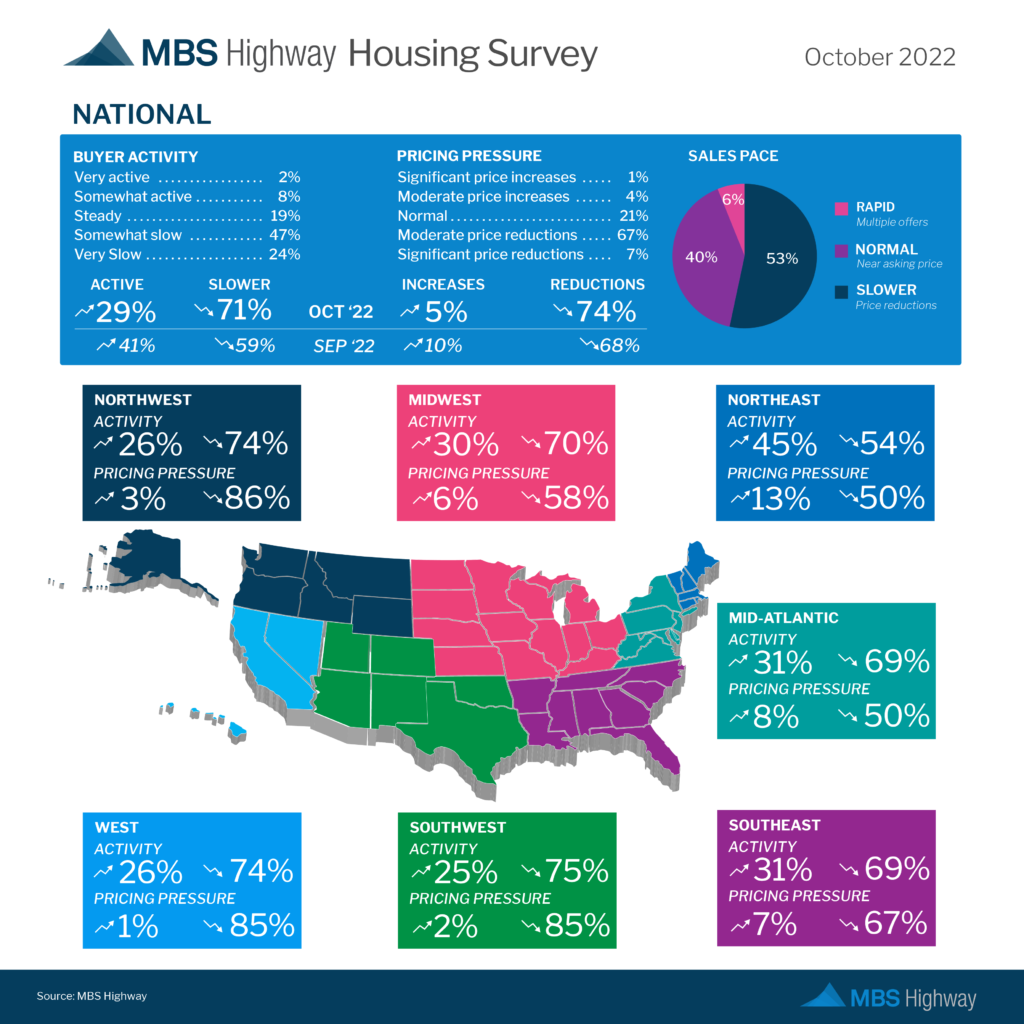

The MBS Highway Survey, which is comprised of roughly 3,000 Mortgage and Real Estate Professionals, was just released for October. There is certainly a slowdown in activity and pricing pressure from September to October, with only 29% of respondents are still citing that their markets are active, while 71% note that it is slower. 5% of those surveyed are still seeing price increases, while 74% are seeing some degree of price decreases, although many of these are listing prices that are coming down to earth and not home value declines.